In the 5th and 4th centuries B.C. Athens fed its population-150,000 by conservative estimates—chiefly on grain imported from south Russia, Sicily, and Egypt, and to a lesser extent, on salt fish from Spain, the Black Sea, and elsewhere. Her formidable fleet of warships was built of timber from Macedon, Asia Minor, and the Levant, her altars burned incense from Arabia, her upper class enjoyed choice foods, textiles, and other luxuries from all over the Mediterranean. This varied, wide-flung, and active commerce was carried on without any of the conveniences that seem so essential today: there were no financial instruments such as paper money, bank checks, letters of credit, or the like; there was no postal service nor other fixed channels of communication: there were no buoys or lighthouses or similar navigational aids to help a skipper off a dangerous coast, or regular naval patrols to protect him against the ubiquitous pirates; and, in case of loss to either, no insurance to cushion the blow for the owners of the ship and cargo. Yet there never was a lack of volunteers for this hazardous way of earning a living.

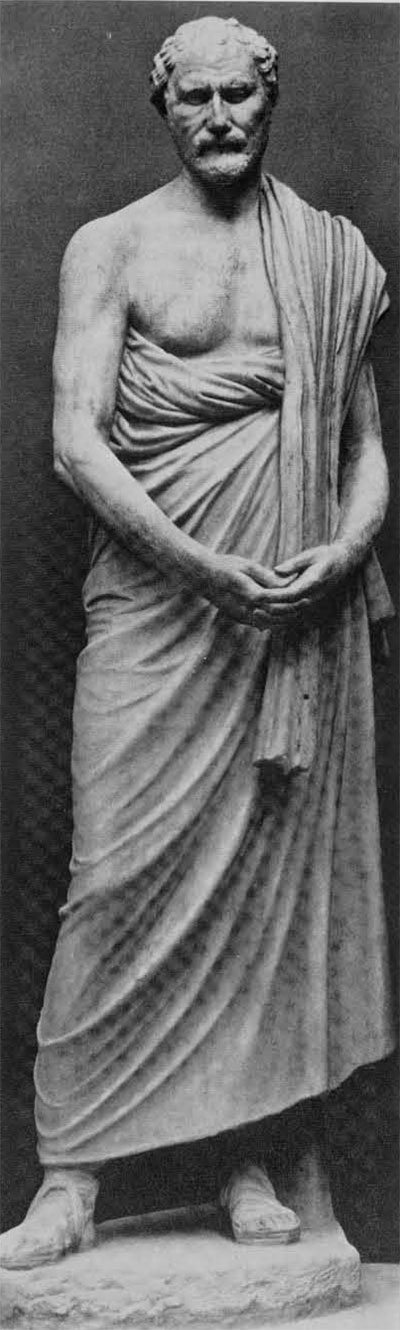

Unfortunately our information about the merchants and their methods of doing business is scanty. Most of it comes from five courtroom speeches prepared by Demosthenes for clients who had gotten into trouble investing their money in commerce, and these show more of the seamier than the normal side of the business. What follows is a brief summary of what we know about the operation of trade in Classical Athens, the roles involved, the men who assumed them, the risks they ran, and the rewards that prompted them to take such risks.

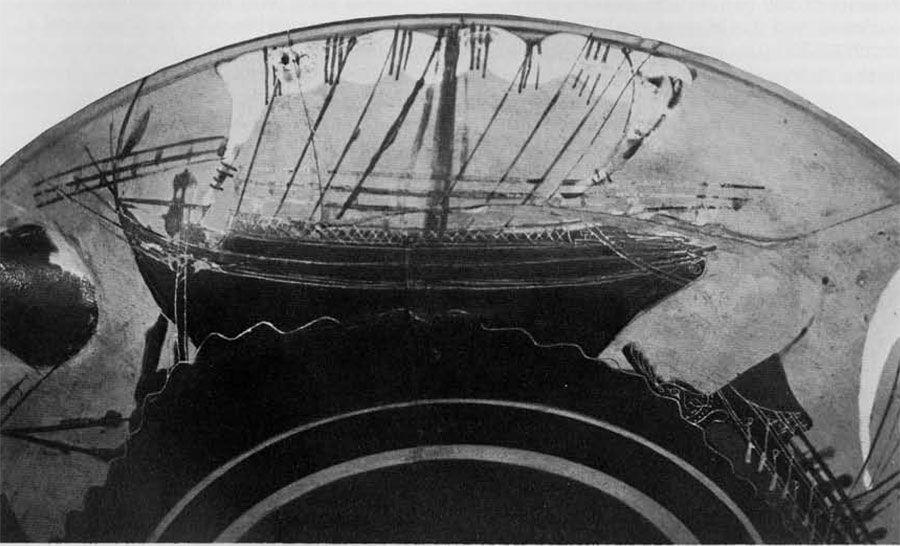

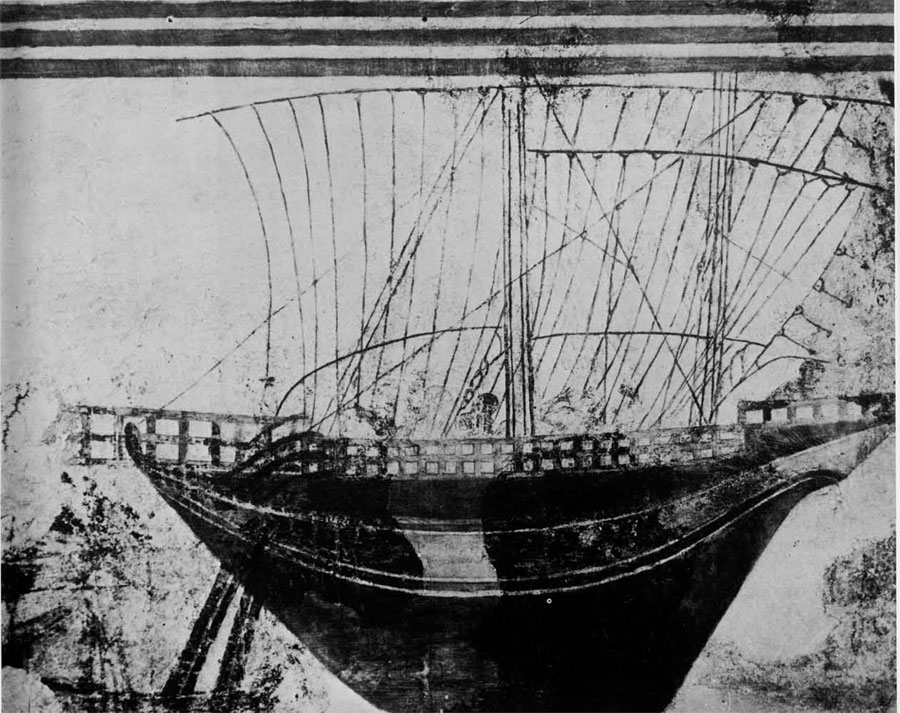

The ships and harbors posed no problem: they were by and large as good as any the world had until only a few centuries ago. The ships were beamy, sailing freighters powered by a broad and low mainsail amidships, sometimes with the addition of a smaller foresail in the bows set on a mast that raked slightly forward. They were underrigged compared even with the likes of Columbus’ clumsy Santa Maria and hence slow (their best speed with a favoring wind was no more than six knots), but in return they were safe. Their capacious hulls offered plenty of cargo space; vessels of 100 to 150 tons burden were common and the biggest could hold as much as 400 (the average for western craft in the 16th century was probably no more than 75). Ships of this size represented a considerable capital investment, for the price covered not only the hull, sail, spars, and rigging but also the crew since these, like most labor in the Greek world at this time, were usually slave, right up to and including the captain.

When a vessel put in at modest coast towns it often had to anchor in the open roads and be unloaded and loaded by barges shuttling from the shore, just as is still done today in parts of the Mediterranean. At Athens, however, and other major emporia, it entered a well-protected harbor, tied up to a stone quay to which it threw over gangplanks, and unloaded onto it; back of the quay were warehouses for storing cargo and porticoes where merchants, shipowners, and money-changers could conduct business shielded from sun and rain.

Ancient maritime trade, with few exceptions, was carried on only during the summer, roughly from May to October. With the coming of fall, ships were put up for the winter, quays were abandoned, and ports, like summer resorts today, went into hibernation. This meant that all activity had to be packed into five months. It also meant that ships, when sailing on the sea, were spared the perils of winter storms and, when loading or unloading in port, were spared delays caused by winter rains and profitted from the long working days of summer. No outcries ever arose on account of those long summer working hours nor of the layoffs in winter, inasmuch as the personnel of the harbors—stevedores, warehousemen, clerks, and the rest—like the sailors, were slave. It goes without saying that strikes were unheard of.

One factor above all determined the way Athens’ trade operated, what roles were played in it, and who filled those roles—the absence of large-scale sources of credit. The ancient trader, for reasons we will give in a moment, worked primarily with borrowed funds, and in Athens of the 5th and 4th centuries B.C. great accumulations of capital able to supply such funds simply did not exist. As a result, all business, industry as well as commerce, was small scale. The biggest manufacturer in Athens owned a shop with no more than one hundred employees. Of the dozen and a half loans to maritime traders whose size we know, the majority were 4000 drachmas or less, enough to purchase, say, no more than twenty or so tons of grain (Demosthenes 34.6, 35.18).

Later ages boasted men or families whose immense private wealth permitted them to lend money on the grand scaleCrassus in Rome of the 1st century B.C., the Medici in Renaissance Florence, the Fuggers in Augsburg of the 15th century, and so on. But the likes of these were completely unknown in Classical Athens. The richest man in town, the banker Pasion who figures in Demosthenes’ courtroom speeches, was a multimillionaire by local standards but no more than moderately wealthy alongside a Cosimo di Medici or Ulrich Fugger.

Later ages boasted, too, massively capitalized banks that could grant lavish loans. Ancient Greece had its banks, to be sure, but they were small and, in any case, the furnishing of credit was a secondary operation. They began as money-changers, and this forever remained a prime function. In those days it involved testing each coin tendered to make sure it was genuine and weighing it to make sure it was up to standard, a time-consuming and exacting procedure which justified the bankers’ agio of 5% as against the minuscule fraction of today. We know that Greek banks took deposits on which they paid interest, usually about 10%, and then invested for their own account; however, the deposits, small to begin with, were returnable on demand, and so bankers had to be wary about where they put such money, and maritime ventures, as we shall see, were far too speculative. Another service a Greek bank offered was safe-deposit; it regularly took care of clients’ spare cash, gold and silver plate, jewelry, and other valuables when their owners left to go on journeys.

With no big banks or wealthy moneylenders to turn to, a trader was reduced to garnering money from miscellaneous people who had funds to invest. Since the funds were never very ample and since the owners preferred to divide what they had among a number of debtors rather than trust all their eggs to one basket, commerce inevitably was a matter of multitudinous small shipments handled by a multitude of small traders. The 400-ton vessels mentioned above each carried the goods of numbers of men, never of one. A cargo of 400 tons of wheat would have required financing to the tune of 80,000 drachmas; the usual maritime loan was 4000, as we indicated. The very largest we know of (Demosthenes 27.11) was of 7000 drachmas to a certain Xuthus, but if he was a broker, not a borrower, as has been argued, then the figure represents more than one loan; see in E. Erxleben and E. Welskopf (Eds.), Hellenische Poleis (Berlin, 1974) 463 and 493.

The trader—or emporos, to. give him his Greek name—needed money not only to purchase what he intended to import or export but also to rent space on a ship. Some were rich enough to own their own vessel—to be a naukleros, to use the Greek expression, as well as emporos—but very few and, in any case, trading for them was a secondary pursuit: they filled a small area in the hold with their own goods and sold the better part of the space to others. Thus, ordinarily, there were three roles involved in a maritime venture: emporos, naukleros, and moneylender. Often, on account of the scantiness of capital available, one or more of the roles was shared by a pair of partners.

The terms of maritime loans were such as to make them attractive strictly to investors strong of heart. To be sure, the traders had to put up security, but in the practice of the times this was either the ship or the cargo, and obviously such security had meaning only after a voyage came to a successful conclusion. At that time, if for some reason a trader dragged his feet about repaying, his creditors could foreclose and recoup their money. Since ships had a fixed and stable value, lenders were willing to lend right up to that value, but on a cargo whose value, being subject to the vagaries of the market, took wide swings, only up to half. In either case it was understood that the borrower was not to take out more than one loan on the same security, that to do so was a most serious offense. If a ship did not make it safely to port—went down in a storm or was captured by pirates or was made to disappear through some skullduggery—the lender lost all. This makes clear why traders operated with borrowed money rather that their own: disaster at sea might rob them of all they had with them, even of their life, but they or their heirs were spared the necessity of paying back a loan that had become purposeless. In return for accepting full responsibility for loss, lenders understandably charged a steep rate of interest. Bank deposits, as mentioned earlier, paid 10%, loans on gilt-edge security such as land 10% to 12%, less well-secured loans as much as 16% to 18%. But a maritime loan might bring 67 1/2% and often as much as 100%. In effect, the rate covered insurance as well as the use of the money.

In one of the courtroom speeches of Demosthenes (35:10-13) the text of a maritime loan agreement is given in full. It is worth quoting, for it illustrates clearly and precisely the people involved, the rewards they stood to gain, and the risks they ran (I have added the rubrics in italics and the notes in brackets]:

Androcles of Athens [this was Demosthenes’ client] and Nausicrates of Carystus have lent to Artemo and Apollodorus of Phaselis [in Lycia, in Asia Minor] 3,000 drachmas, for a voyage from Athens to Mende or Scione [both in north Greece] and thence to Bosporus [in the Crimea], or, if they so desire, to the north shore of the Pontus [Black Sea] as far as the Borysthenes [Dnieper], and thence back to Athens, on interest at the rate of 225 drachmas on the 1,000 [221/2% for 4-5 months =671/2% per annum]—however, if they should leave the Pontus for the return voyage after the middle of September [that is, run the danger of hitting equinoctial storms], the interest is to be 300 drachmas on the 1,000 [30% for 4-5 months =90% per annum]—on the security of 3,000 jars of wine of Mende which shall be conveyed from Mende or Scione in the ship of which Hyblesius is owner [that is, a chartered vessel].

They provide these goods as security, owing no money on them to any other person, nor will they make any additional loan on this security.

They agree to bring back to Athens in the same vessel all the goods [certainly grain] put on board as a return cargo while in the Pontus.

If the return cargo is brought safely to Athens, the borrowers are to pay the lenders the money due in accordance with this agreement within 20 days after they shall have arrived at Athens, without deduction save for such jettison as the passengers shall have made by common agreement, or for money paid to enemies [the inevitable pirates] but without deduction for any other loss.

They shall deliver to the lenders all the goods offered as security to be under the latter’s absolute control until such time as they themselves have paid the money due in accordance with the agreement.

If they shall not pay back within the time stipulated the lenders have the right to pledge or even to sell the goods for whatever price they can get, and if the proceeds of the sale fall short of the sum the lenders are entitled to in accordance with the agreement, they have the right to collect [the difference] by proceeding, severally or jointly, against Artemo and Apollodorus and against all their property whether on land or sea, wherever it may be.

After several further stipulations the agreement closes with the signatures of the parties and witnesses.

As Demosthenes’ brief reveals, the borrowers, Artemo and Apollodorus, managed to break every provision in the contract. First, they loaded aboard only 450 jars of wine instead of the specified 3000. Next, they proceeded to float another loan on the same security. Then they left the Black Sea to go back to Athens without a return cargo. Finally, on arrival they put in not at the port but at the smugglers’ cove, Thieves’ Harbor as it was called. Time passed, and the creditors, seeing no sign either of their money or of any merchandise which they could attach, confronted the pair and were blandly told that the cargo had been lost in a storm and hence all obligations were off. Fortunately the creditors were able to produce sworn depositions from passengers and crew that no cargo of wine or grain had been aboard.

Note that, of the four parties to the agreement, three—the trading partners and one of the lenders—were non-Athenians. So too was the shipowner, as we find out elsewhere. There was good reason for this. The form of investment that was safest and boasted the highest social tone was real estate. But ownership of real estate, whether land or houses, was open solely to Athenian citizens. This meant as well that only they could make loans secured by real estate. They turned to maritime ventures only when it suited them. Foreigners, on the other hand, had no alternative; (see Lionel Casson, “The Athenian Upper Class and New Comedy.” Transactions of the American Philologicol Association 106 [1976] for the part played by them in Athenian trade.) However, since there was money to be made in the business, they were willing volunteers. Of the three roles involved, shipowning and trading and moneylending, they almost totally monopolized the first: practically all the vessels that carried products in and out of the Piraeus belonged to men from Marseille, Byzantium, south Russia, Asia Minor, and so on. Athenians, with more attractive possibilities open to them, preferred to leave to others an investment that was of considerable size (remember that the shipowner laid out for the crew of slaves as well as the vessel), that stood idle for half the year, and that could be lost in the twinkling of an eye during the other half. In the second, trading, foreigners were easily in the majority, although there were plenty of Athenians taking part along with them. Indeed, in the comedies of this period, a standard character is the Athenian father who goes off overseas on business, leaving a ne’er-do-well son free to sow wild oats and start the wheels of the plot spinning. And, in the third, the financing of maritime ventures, Athenians outnumbered non-Athenians by a good margin.

It was the size of the return that tempted them. Real estate was a fine form of investment, safe and prestigious, but it yielded no more than 8%. Keeping money on deposit in a bank or lending on good security brought, as we have seen, only 10% to 18%. Running a factory might net 20% or more—but even though factories were small they still forced an owner to tie up for life a considerable amount of capital in the work-force of slaves. A maritime loan, on the other hand, could double a man’s money within the few months of the sailing season; it was the one way in ancient Athens to make a quick financial killing.

But to make such a killing one’s ship had to come in. And so, prudent Athenians did not put all their spare funds in such ventures any more than investors today would put all theirs in speculative common stocks. We happen to know that Demosthenes’ father, at the time of his death, had (Demosthenes 27.9-11):

8000 drachmas in cash

6000 in small interest-free loans to friends

3000 on deposit in banks, presumably at 10%

1600 on loan, interest rate unknown 6000 on loan at 12%

4000 in a loan secured by a shop that yielded a profit of 1200 annually = 30% (although probably only 20% on the actual, and not the loan, value of the slaves involved)

7000 in a maritime loan

Thus, 7000 of 35,600 drachmas or 22 1/2% was in maritime loans.

To undertake these risky investments one had to be experienced as well as bold; they were not for the uninitiated. In the contract cited above we have seen the tricks and turns taken by the borrowers to evade paying back what they owed to Demosthenes’ client. Another of his courtroom speeches (32) was on behalf of a relative of his who had the misfortune to get mixed up with a pair of rascals from Marseille; they, after pledging the selfsame cargo for a whole series of loans, quietly sent off the boodle to their home town for safekeeping and then, since repayment had to be made only upon the ship’s arrival, launched a scheme to scuttle it. Though they fumbled the attempt and the ship did reach port, and though the case against them was in the hands of Athens’ most celebrated lawyer, the indications are that the poor lender never saw his money again. Even an old hand, one who “not quite seven years ago gave up voyaging myself and, having a fair amount of capital, try to put it to work in maritime loans,” chose badly and found himself enmeshed in a lawsuit (Demosthenes 33.4). It was a field for “those who have made a trade of the business,” as Demosthenes puts it (37.53), an emporos or naukleros (34.6) with spare cash, or someone like the Diodotus we hear of who “had made a lot of money out of trade” and at his death had 46,000 drachmas out of a liquid capital of 92,000—exactly 50%—in maritime loans. Diodotus’ story is told by another 4th century Athenian orator, Lysias 34.2-6, 13-15.

On top of all the dangers from acts of God and godless men there was yet another, the need to deal in cash, to carry about large and heavy amounts of coin. A trader’s method of procedure was more or less as follows. First he made his way to the waterfront to line up a shipowner with space available headed for the destination he had in mind. He then ranged up and down the porticoes back of the quay at the Piraeus, where men with money to invest or their agents gathered, until he found one or more willing to grant him a loan. The two parties, after drawing up a written agreement, repaired to the office— the same as his home—of some banker they knew and trusted. There, under his eyes, the lender or lenders passed over the coin, and the agreement was left with the banker for safekeeping. No writing accompanied the transfer of the money, no receipts were executed in duplicate or the like—something we feel so necessary. Greek businessmen of this age preferred to work orally before witnesses. The trader had a slave shoulder the sack or sacks of coin and accompany him to the ship. He either went aboard himself or entrusted cash and mission to an agent; the latter might be an Athenian employed by him as associate or a slave of his who served as his man of affairs and had full authority to act in his name. If the voyage ended successfully, the trader summoned his creditor(s) to a meeting at the banker’s office and there, again with him as witness, handed over in cash the amount of the loan plus interest, and the parties wrote finis to the deal by tearing up the written agreement.

A successful voyage meant not only that the ship had made it safely back but that the market price of the cargo had held up, permitting the trader to reap a very handsome gross profit. It took such a profit to leave a margin for himself after all the various costs had been covered—the massive interest charges, the freight, and the 5% agio if he had to change any money. In those days there were three currencies which, like the dollar today, enjoyed international circulation—Athens’ silver 4-drachma pieces, Cyzicus’ electrum staters, and Persia’s gold darics. If a trader’s cargo was, say, a load of grain from south Russia which annually shipped thousands of tons to Athens, no doubt the dealers there accepted his Athenian coins. But if he were operating where men preferred the local currency, he would have to pay the moneylenders their not inconsiderable due.

No matter how carefully one drew up a contract, overlooked details or unforeseen circumstances could bring the parties into conflict, even though they both acted with all the goodwill in the world. And when one of them, as was so often true in maritime ventures, was a non-Athenian, adjudicating conflicts posed special problems. Since these foreigners were vitally important to Athens, links in the chain of grain imports that kept the city fed, Athens was concerned that they receive swift and efficient justice. She passed a law that cases involving traders had to go on no later than one month after the original complaint had been lodged; no trader was to be lured away to sell his grain at Corinth or Samos just because Athens had kept him waiting around for justice until his name came up on some overcrowded court calendar. And, whereas in other cases the penalty usually was a fine, those involving traders carried prison sentences. This helped both parties: if an Athenian won a case against a foreigner, the prison sentence guaranteed that the latter could not settle matters in his own way by taking off in his ship without paying the judgment; conversely, if the Athenian lost, fear of prison made him pay up promptly and not compel the foreigner, whose home might be hundreds of miles away, to hang around Athens and go through endless red tape collecting on the judgment.

The foreign businessman had yet another source of help, his proxenos. A proxenos was the nearest thing to a consul to be found in the ancient world. He was usually a foreigner from another Greek city permanently residing at Athens who was officially acknowledged by the Athenian government to be the Accredited Representative of citizens of his home town. If, for example, a trader from Corinth needed advice about doing business at Athens or introductions to moneylenders or help with a law case, he sought out the Corinthian proxenos.

“It would be an excellent idea,” is Xenophon’s advice to his countrymen (De Vectigalibus 3.4), “to honor traders and shipowners with front-row seats at the theatre, and issue occasional invitations to dinner at City Hall to those of them who, through exceptional shipping and shipments, appear to be benefactors of the city.” Xenophon knew on which side Athens’ bread was buttered—or rather, that without the traders and shipowners there would be scant bread to butter.